-

Chile

All three of the Interra Copper's Chilean projects are located in the Central Volcanic Zone (CVZ), an area of considerable volcanic activity as a result of the subduction of the Nazca Plate (ocean) below the Central Andes Plate (continental).

REGIONAL GEOLOGY: Central Volcanic Zone “CVZ”

All three of the Alto Verde Copper projects are located in the Central Volcanic Zone (CVZ), an area of considerable volcanic activity as a result of the subduction of the Nazca Plate (ocean) below the Central Andes Plate (continental).

The Chilean part of the CVZ hosts >30 large stratovolcano complexes, both along the border with Bolivia and Argentina and within Chile.

While volcanic activity has extended to the present day in some cases, a significant proportion of the known large porphyry deposits in Chile are Tertiary in age (2 – 66 Ma), with hydrothermal activity associated with late Eocene to Oligocene intrusives in multiple stages (hypogene deposits); supergene enrichment can represent a significant proportion of the overall resource in these deposits.

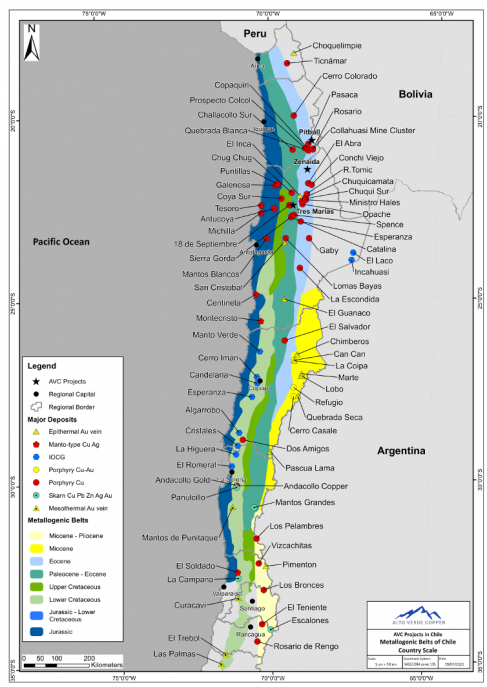

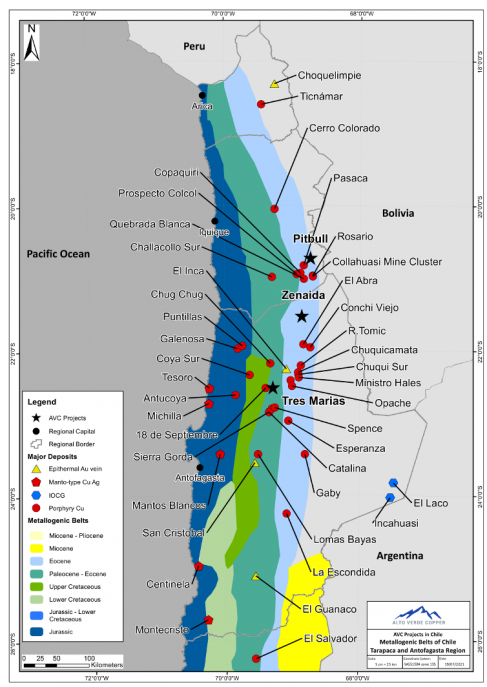

While the geological model for all three projects will evolve, the map below illustrates where the projects are located, the proximity to the known large deposits within the CVZ, and overall prospectivity.

The Chilean Copper Belt

The geological setting in Chile is unparalleled in its mineral endowment. This has spawned a very strong mining industry which remains one of Chile’s largest contributors to the national economy. At the forefront of this industry is the production of copper, and the associated exploration for it.

As the largest copper producer in the world, Chile hosts many notable copper miners, including Antofagasta Minerals, BHP Billiton, Glencore, Freeport-McMoRan and Codelco among others, and there has been significant exploration and production in the region for decades. With its well-developed sector, Chile is also known as a highly favourable mining jurisdiction within South America, with a long history of strong mining laws supporting foreign direct investment.

The northern region of the country is the predominant production center for copper, with much coming from from porphyry-style deposits that are rich in copper, molybdenum, gold and silver by-products. This region lies on the the Central Volcanic Zone (CVZ), an area of considerable volcanic activity as a result of the subduction of the Nazca Plate (ocean) below this Central Andes Plate (continental), commonly referred to as the Chilean Copper Belt.

The Chilean Copper Belt holds a narrow zone of porphyry copper deposits stretching over 2,000km along the Central Andes plate and extending further into Peru. The Chilean part of the CVZ hosts more than 30 large stratovolcano complexes, both along the border with Bolivia and Argentina and within Chile. All three of the Alto Verde Copper projects are located on the belt.

This northern region of Chile can be geologically divided into four north-south, coast-parallel metallogenic belts which from west to east are:

(1) Mesozoic Coastal Belt (Jurassic-Cretaceous)

(2) Paleocene-Lower Eocene Central Belt; (Tres Marias)

(3) Upper Eocene-Lower Oligocene (Mid-Tertiary) Belt; (Pitbull, Zenaida)

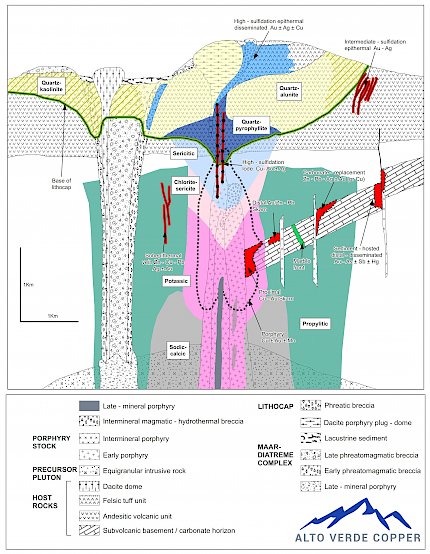

(4) Miocene High-Cordillera BeltGiven the location of all three projects, the Company is principally searching for Porphyry Copper Deposits or “PCDs”. Mineralized systems associated with PCDs commonly include polymetallic skarn, carbonate replacement (i.e., manto copper), sediment-hosted gold silver, and high, intermediate and low sulphidation epithermal silver-gold-base metal deposit types.

Schematic model showing the components of a porphyry copper-precious metal and polymetallic system with various deposit types and mineralization styles (shaded red, blue and purple) associated with the porphyry intrusive centre (shaded pink)

(Source: Sillitoe, 2010)

Project Ownership*

Alto Verde Copper Inc., acquired 100% of the Tres Marías, Pitbull and Zenaida mining concessions from Minera Freeport-McMoRan South America Limitada (“MFMSA”), a wholly owned subsidiary of Freeport-McMoRan Inc. The Tres Marías project is subject to a purchase option by MFMSA such that upon completing US$5 million of qualifying exploration expenditures on the property within 5 years, MFMSA shall have the right to acquire either a 51% interest in MTM’s share capital for US$12.5 million, a 49% interest in MTM’s share capital for a nominal amount, OR not acquire any interest in MTM. If MFMSA acquires a 51% interest in MTM’s share capital, Alto Verde will be granted a 0.5% NSR royalty over the Property. If MFMSA acquries a 49% interest or 0% interest in MTM’s share capital, MFMSA will be granted a 1.0% NSR royalty over the Property. MFMSA also holds a 1% NSR Royalty on both the Pitbull and Zenaida properties.Projects

Register to receive news via email from Interra Copper Corp.

* Required FieldsForm not found